The European economic crisis has been part of some previous maps shown on this website. So far, all of these maps on Europe’s debt were based on national-level data which do not show the full picture of the economic structure of the European countries. A couple of weeks ago EUROSTAT published some more detailed economic data for the GDP output on NUTS 2 level, which allows to understand the subnational variation of economic output. The data only covers data ranging from 1997 to 2008 (so far), but it is the most detailed coherent picture of the shifting economic powers within the EU27 countries in over a decade and draws the picture of the European Union sliding into the global economic crisis.

I looked at the data in a series of maps that view the economic shape of the European Union from different perspectives. The first map displays the GDP distribution in the first year of the financial crisis (2008) and the NUTS2-areas are redrawn according to their total GDP output in that year. The colours indicate the GDP growth rate in that year, showing how well many parts still dealt with the approaching crisis, and as if the crisis followed a geographical path from its US origins, the UK and Irish economies were the first to be severely hit in their economic growth in the year of the Lehman collapse. Only Sweden shows a similar bleak picture, but on a much lower level. It is interesting to see that the initially collapsing banking sector in London is not only affecting the GDP development in the Southeast of the UK, but basically pulls the whole national economy into a downturn:

The ongoing debate about the European debt crisis in the aftermath of the global economic crisis is “overshadowed” by ‘accelerating growth rates’ (BBC) according to the latest growth figures. In fact, despite all the talk about crisis, downturn and debt it often is forgotten that even with a decline in GDP there is still considerable economic activity, and GDP output itself is not a zero figure story. The size of the UK in the first map indeed shows how big the country still is in the european economic activity, even if the negative GDP changes also mean that the decline itself is even worse in total figures.

A look at the economic development in the European Union in the last 1 1/2 decades shows, how the activity levels are slowly shifting eastwards, and how the Eastern European countries started to catch up with the Western European economies in the years before the crisis. An animation of NUTS2-level GDP cartograms (NUTS2-areas resized again according to their total economic output) makes these changes clearly visible. A flourishing UK economy in the late nineties slowly gets diminished by the emerging new EU member states in the noughties, before it collapses in the year of the crisis in 2008. Compared to these relative shift of economic power between west and east, the position of the large economies of France and Germany appears like a stable rock in the middle of these changes. Here are the changes in all detail:

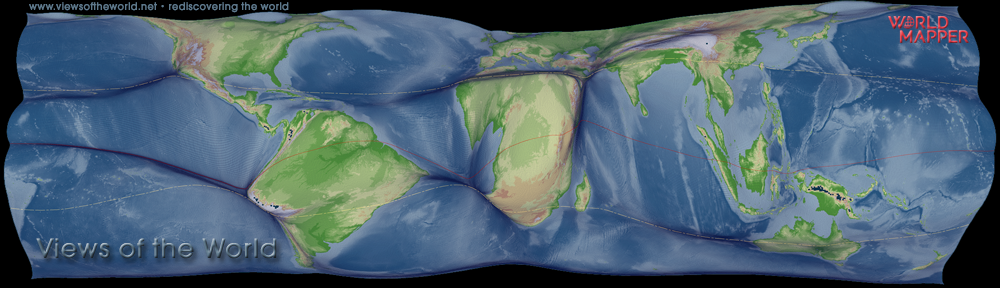

The focus on the economic shapes and changes does show only one side of the state of the union. Economic activity is highly unequal in its distribution, as the highest economic output – neither on national levels, nor on European level – is not always there where most people live. These disparities can be highlighted when viewing the economic output from a population perspective. The following map is an equal-population projection that resizes the areas on the map according to the total population. The NUTS2-areas are then coloured by the deviation from the mean economic output levels. The yellow regions meander around the average GDP levels, while red indicates lower than average (<-0.5 Std Dev.) and the two shadings of blue above average (0.5-1.5 Std. Dev. and >1.5 Std. Dev. for the darkest blue) economic activity. The level of detail that is shown in the new EUROSTAT data allows a detailed interpretation of the regional differences in economic output in relation to the population. The City of London – even in the year of the financial crisis – stands out from the rest of the UK, Germany’s most productive areas are concentrated in the west and south, while Italy’s economic strength concentrates largely in the north. Spain’s vegetable and fruit production on the southern shores complement the commercial and political capital Madrid, while large parts of the Eastern Europe member populations are still far below the average levels of economic activity, which explains why the shifting GDP shares shown in the above animation are essential to balance the economic structure within the EU:

More recent data on the EU economy in the same detail is currently not available. But despite the debt crisis, the overall picture given in these maps will not look very different today, as the shapes of the cartograms show the shares of the different regions, rather than total figures. The impact of the crisis will therefore have led to gradual changes, rather than substantial modifications of the economic structure. Apart from the growth levels shown in the first map, these maps will therefore be a quite accurate depiction of the economic shape of the EU regions and the prevailing trend of shifting economic powers.

For more maps like these showing the social and economic state of a bankrupt country in all its detail, I recommend the new Policy Press Book “Bankrupt Britain: An Atlas of Social Change” which coincidentally has been written (& mapped) by some Sheffield Geographers (Bethan Thomas & Danny Dorling) and continues the great tradition of drawing maps on population cartograms. The book companion website has all the details about the book and provides some great samples, updated maps and all the data that was used to create the maps in this Atlas. Now we only need a book like this about Europe…

For more maps like these showing the social and economic state of a bankrupt country in all its detail, I recommend the new Policy Press Book “Bankrupt Britain: An Atlas of Social Change” which coincidentally has been written (& mapped) by some Sheffield Geographers (Bethan Thomas & Danny Dorling) and continues the great tradition of drawing maps on population cartograms. The book companion website has all the details about the book and provides some great samples, updated maps and all the data that was used to create the maps in this Atlas. Now we only need a book like this about Europe…

Thanks also to Alasdair Rae from the Sheffield Town Planning Department for pointing me to the EU data source. He gives his own take on the data on his website.

The content on this page has been created by Benjamin Hennig. Please contact me for further details on the terms of use.

Pingback: Küresel Ekonomik Kriz ve AB’nin Geleceği Üzerine Bir Deneme | TUİÇ Akademi