Amid Europe’s debt crisis it remains less noticed that the largest mountain of debt in the world is piled up across the big pond in the United States of America. The topic will be critically debated in US politics as presidential elections are due in 2012. In an article for the “In Focus” section of Political Insight (December 2011, Volume 2, Issue 3) Danny Dorling and I took a closer look at the foreign liabilities of America’s debt.

Amid Europe’s debt crisis it remains less noticed that the largest mountain of debt in the world is piled up across the big pond in the United States of America. The topic will be critically debated in US politics as presidential elections are due in 2012. In an article for the “In Focus” section of Political Insight (December 2011, Volume 2, Issue 3) Danny Dorling and I took a closer look at the foreign liabilities of America’s debt.

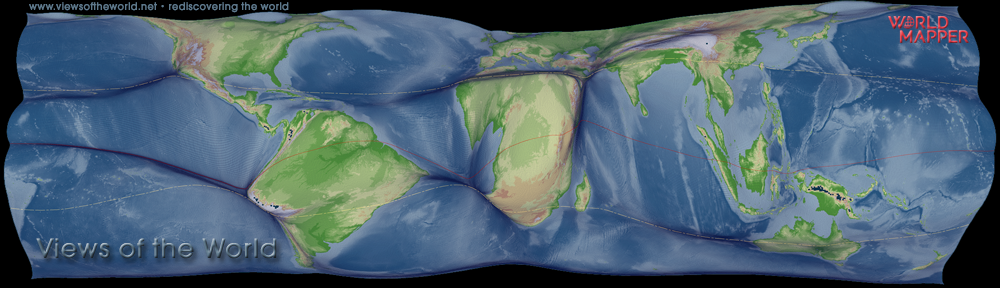

The map we created for this feature is a cartogram with the world’s countries resized according to the total amount of US treasury securities that are held in each country (as shown in data from July 2011). This is a preview of the maps that we created for the article:

Continue reading

Tag Archives: debt

$54 Trillion Debt

Soaring debts and plummeting stocks – the financial state of world hasn’t changed a lot in the last years. With debt levels continuing to rise, and economic activity stagnating, the impact appears to lead to yet another financial crisis (isn’t it the same crisis that we are in for three years now?). The following cartogram shows the countries of the world resized to their total public debt in 2011 as estimated by the IMF (data taken from the World Economic Outlook 2011, with additional data from EUROSTAT and other IMF publications). To put the total values into perspective, the countries are coloured by the public debt to GDP ratio (see below for a worldmapper-coloured version of the same map). The small reference map shows the estimated GDP output in 2011, allowing a comparison of global distribution of public debt and the distribution of economic activity:

The World of America’s Debt

The financial crisis continues to make it into the headlines. Mountains of debt piled up by the world’s wealthiest nations (as shown in this map) stir up the financial markets and indicate that political measures since the early days of the economic meltdown in 2008 had little impact or simply were too meaningless to induce a real change into the mechanisms of the markets. The EU keeps struggling to calm investors over fears of yet another country going bust while on the other side of the pond the rating agencies start playing games with the world’s largest economy. As the NYT explains, The rating agency thinks the United States has too much debt, or at least will: “Under our revised base case fiscal scenario — which we consider to be consistent with a AA+ long-term rating and a negative outlook — we now project that net general government debt would rise from an estimated 74 percent of G.D.P. by the end of 2011 to 79 percent in 2015 and 85 percent by 2021.” (read more about credit agency ratings in the A ‘AAA’ Q. and A.). After some brief debates about credit agencies not long ago, these discussions seem to have disappeared again, and the old mechanisms of nervous investors and even more nervous decision makers, like it always did in the last three years.

At the same time an emerging super power starts to find its own political voice against its perhaps largest rival: After years of growing economic dominance, China seems to gain confidence in confronting the USA with bold statements. As the largest holder of US debt, they may start to worry with the investors’ decline in trust in America, causing China to warn America over its addiction to debt.

The current American debt levels did not come out of the blue, but have long started piling up, as a look at the development of US debt over the last decade shows: The total national debt of the United States is at $14.3 trillion this year, up from $5.8 trillion in 2001. Particularly interesting for the global markets is the external debt that the USA owes to foreign holders outside the country. Here George W. Bush took over approximately $1 trillion in foreign debt from the Clinton administration (Bill Clinton managed to induce a reduction in national debt levels in his second term). After a short period in which this downward trend continued, foreign US debt started to rise after September 2001, and Bush handed over more than $3 trillion of National debt to Barak Obama in 2009, with a considerable trend upwards since the financial crisis hit the nation in 2008. Only recently this upward trend started to level off slightly, and foreign debt is now just below $4.5 trillion. Besides China, as the largest single holder of foreign US debt, the liabilities are spread around the globe, with a considerable amount of debt being held by some of the other indebted economies such as the United Kingdom (as the country with the largest external debt of European countries). The following map shows the countries of the world resized according to the total amount of US treasury securities that are held in that country. It uses the most recent data published by the US Treasury:

Shifting Economies in the European Union

The European economic crisis has been part of some previous maps shown on this website. So far, all of these maps on Europe’s debt were based on national-level data which do not show the full picture of the economic structure of the European countries. A couple of weeks ago EUROSTAT published some more detailed economic data for the GDP output on NUTS 2 level, which allows to understand the subnational variation of economic output. The data only covers data ranging from 1997 to 2008 (so far), but it is the most detailed coherent picture of the shifting economic powers within the EU27 countries in over a decade and draws the picture of the European Union sliding into the global economic crisis.

I looked at the data in a series of maps that view the economic shape of the European Union from different perspectives. The first map displays the GDP distribution in the first year of the financial crisis (2008) and the NUTS2-areas are redrawn according to their total GDP output in that year. The colours indicate the GDP growth rate in that year, showing how well many parts still dealt with the approaching crisis, and as if the crisis followed a geographical path from its US origins, the UK and Irish economies were the first to be severely hit in their economic growth in the year of the Lehman collapse. Only Sweden shows a similar bleak picture, but on a much lower level. It is interesting to see that the initially collapsing banking sector in London is not only affecting the GDP development in the Southeast of the UK, but basically pulls the whole national economy into a downturn:

In Focus: Government Debt

A map showing the Europe’s government debt is now featured in the “In Focus” section of Political Insight journal (December 2010, Volume 1, Issue 3). The accompanying article written by Danny Dorling and me explains why the UK’s deficit is particularly high.

A map showing the Europe’s government debt is now featured in the “In Focus” section of Political Insight journal (December 2010, Volume 1, Issue 3). The accompanying article written by Danny Dorling and me explains why the UK’s deficit is particularly high.

Here are the bibliographic details:

- Dorling, D. and Hennig, B. D. (2010). In Focus: Government Debt. Political Insight1 (3): 106.

Article online (Wiley)

More debt maps can be found here.

The content on this page has been created by Benjamin Hennig. Please contact me for further details on the terms of use.

Europe in debt

People across the worst hit countries by the proposed austerity measures to reduce national debt levels gathered on the streets of many European cities to protest against public spending cuts. The financial crash hugely affected many government across the EU with little signs of a quick recovery of the public debt levels.

The following map shows how Europe is left in deficit two years after Lehman (and that in fact the EURO zone isn’t worse off than EU members without the common currency). There may be signs of recovery, but this picture will certainly stay with us for a while: