The financial crisis continues to make it into the headlines. Mountains of debt piled up by the world’s wealthiest nations (as shown in this map) stir up the financial markets and indicate that political measures since the early days of the economic meltdown in 2008 had little impact or simply were too meaningless to induce a real change into the mechanisms of the markets. The EU keeps struggling to calm investors over fears of yet another country going bust while on the other side of the pond the rating agencies start playing games with the world’s largest economy. As the NYT explains, The rating agency thinks the United States has too much debt, or at least will: “Under our revised base case fiscal scenario — which we consider to be consistent with a AA+ long-term rating and a negative outlook — we now project that net general government debt would rise from an estimated 74 percent of G.D.P. by the end of 2011 to 79 percent in 2015 and 85 percent by 2021.” (read more about credit agency ratings in the A ‘AAA’ Q. and A.). After some brief debates about credit agencies not long ago, these discussions seem to have disappeared again, and the old mechanisms of nervous investors and even more nervous decision makers, like it always did in the last three years.

At the same time an emerging super power starts to find its own political voice against its perhaps largest rival: After years of growing economic dominance, China seems to gain confidence in confronting the USA with bold statements. As the largest holder of US debt, they may start to worry with the investors’ decline in trust in America, causing China to warn America over its addiction to debt.

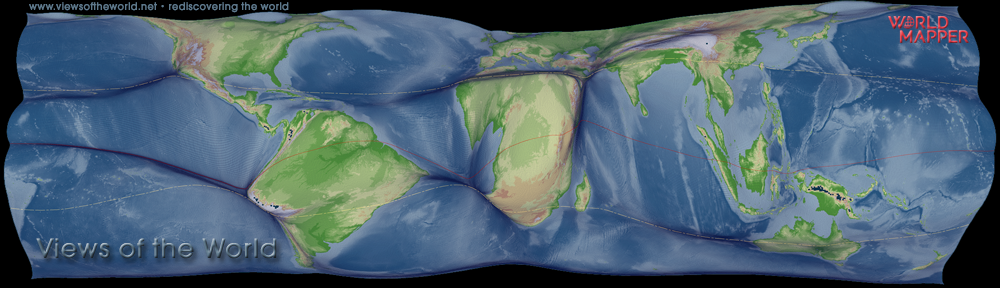

The current American debt levels did not come out of the blue, but have long started piling up, as a look at the development of US debt over the last decade shows: The total national debt of the United States is at $14.3 trillion this year, up from $5.8 trillion in 2001. Particularly interesting for the global markets is the external debt that the USA owes to foreign holders outside the country. Here George W. Bush took over approximately $1 trillion in foreign debt from the Clinton administration (Bill Clinton managed to induce a reduction in national debt levels in his second term). After a short period in which this downward trend continued, foreign US debt started to rise after September 2001, and Bush handed over more than $3 trillion of National debt to Barak Obama in 2009, with a considerable trend upwards since the financial crisis hit the nation in 2008. Only recently this upward trend started to level off slightly, and foreign debt is now just below $4.5 trillion. Besides China, as the largest single holder of foreign US debt, the liabilities are spread around the globe, with a considerable amount of debt being held by some of the other indebted economies such as the United Kingdom (as the country with the largest external debt of European countries). The following map shows the countries of the world resized according to the total amount of US treasury securities that are held in that country. It uses the most recent data published by the US Treasury:

As the US Treasury does not release the full list of foreign debt for all countries, a few adjustments were necessary to produce this map. All countries holding less than $12.3 billion were merged into one ‘All Other’ category. As this does not tell where the debt is, this single figure ($202.5 billion, less than 4.5% of the total foreign debt in total) has been applied to the area of Antarctica in this map. This allows to see the total distribution of all debt, including that which can not be further distributed over the missing countries. As it is so low (and each country itself would have less than the largest country included in the data, i.e. Australia with $12.3 billion), it would have little impact on the overall appearance of the map.

Furthermore, the US Treasury publishes the a single figure for all Oil Exporting nations (Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria) as well as the Caribbean Banking Centres (Bahamas, Bermuda, Cayman Islands, Netherlands Antilles, Panama, and British Virgin Islands). Here again a compromise was necessary to include those countries in the cartogram. For both categories the respective countries were merged and treated as one homogeneous region in the map transformation. The distribution of US debt within those countries may therefore differ from the representation in the map, while the overall shape still gives a good indication of the distribution of debt, not least because the overall number for both areas does not dominate the overall distribution. Both regions are clearly marked in the map with the red respectively yellow outline and the crisscross / dotted pattern.

As some people prefer conventional maps to cartograms, there is also a more traditional view to these figures available from the people of Development Seed. Their map shows the US foreign debt as bubbles (for those countries where data is available as a single figure). The map can interactively be panned and zoomed, and it also shows further historic data when moving the mouse pointer over the bubbles:

And how did we get into this mess? In 2006 filmmaker Danny Schechter released his film In Debt we Trust, not only a telling name, but almost a prophecy of the things to come in the years after. As stated in the editorial review, the documentary is the story of 21st-century serfdom and shows how the new American way of life has shaped over the years into what we witness now as a continuation of the financial crisis. “The whole world depends on the economic stability of the United States. Yet, as its national and consumer debt escalates, our interconnected global economy is at incredible risk. IN DEBT WE TRUST, as timely and relevant as a film can be, delivers an urgent warning that can’t be ignored.“. For those who don’t want to get into debt for watching the film, it also is available online:

The content on this page has been created by Benjamin Hennig. Please contact me for further details on the terms of use.