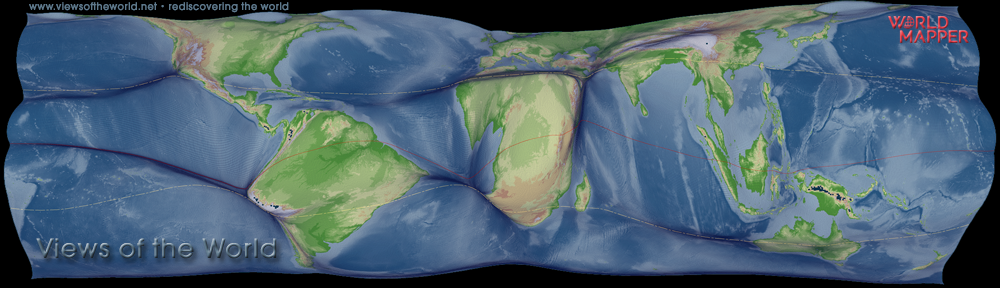

Soaring debts and plummeting stocks – the financial state of world hasn’t changed a lot in the last years. With debt levels continuing to rise, and economic activity stagnating, the impact appears to lead to yet another financial crisis (isn’t it the same crisis that we are in for three years now?). The following cartogram shows the countries of the world resized to their total public debt in 2011 as estimated by the IMF (data taken from the World Economic Outlook 2011, with additional data from EUROSTAT and other IMF publications). To put the total values into perspective, the countries are coloured by the public debt to GDP ratio (see below for a worldmapper-coloured version of the same map). The small reference map shows the estimated GDP output in 2011, allowing a comparison of global distribution of public debt and the distribution of economic activity:

9030 miles high, that alone is the pile of America’s debt in $100 bills, how graphics designer Nigel Holes explained quite nicely in a recent episode of BBC Radio 4’s number-geeks programme More or Less (the US debt clock may also appeal to the number geeks). This is a lot more than the pile of debt made in a similar calculation by US President Ronald Reagen in 1981, who stacked the US debt in $1000 bills and only reached 67 miles high (670 miles in $100 bills…). Quite interesting to get an idea of the dimensions of debt are also the visualisations on http://usdebt.kleptocracy.us/ where the US debt is compared to piles of money in relation to other things such as the Statue of Liberty (more about this can also be seen and read in last week’s map).

The USA was not the only country to be haunted by the attention of credit rating agencies and panicking investors on the world’s stock markets. Together with more and more countries in the Eurozone, the USA is the large part of the world’s wealthiest nations getting into difficulties over their public overspending. It’s not that this all comes out of surprise, because most of the numbers shown in the map are out and known for a while, as public overspending started long ago and accelerated latest with the financial crisis in 2008. Gambling on market’s ups and downs is part of the mechanics of the financial world. Public debt is part of that world, as countries have to borrow their money from these very same markets that tumbled in 2008, and where psychology plays an as important role as economics.

Speculations about France’s financial problems therefore did not come out of the blue. They are part of the gamble, and France’s public debt is high enough (in total and in GDP shares) that flatlining economic figures cause another worry for those still having money to lend to others. Who is next? The UK? Or even Germany? It’s near beyond the moon, literally: World’s public debt levels stacked in $1 bills would reach to the moon – not one time, but almost 14 times: According to the IMF data that I used for this map, the total public debt of all countries combined sums up to an estimated $54 trillion in 2011 (which equals 3.402 miles of $1 bills – 13.9 times the distance to the moon – or 34,020 miles of $100 bills – which could be wrapped 1.4 times around the world when put on a stack). The largest debtors (beyond the USA and France, who are already making the headlines, this also includes the UK and Germany in the European Union) have a public debt of more than three quarters of their annual GDP output.

So again, where next? Is Nouriel Roubini of New York University’s Stern School of Business right? And if so, where does a G-Zero world head economically if it is true what Roubini says:

Today, the United States lacks the resources to continue as the primary provider of global public goods. Europe is fully occupied for the moment with saving the eurozone. Japan is likewise tied down with complex political and economic problems at home. None of these powers’ governments has the time, resources, or domestic political capital needed for a new bout of international heavy lifting. Meanwhile, there are no credible answers to transnational challenges without the direct involvement of emerging powers such as Brazil, China, and India. Yet these countries are far too focused on domestic development to welcome the burdens that come with new responsibilities abroad. (Quoted from ‘A G-Zero World‘)

If the world is playing “a game in which my win is your loss“, then any collaborative efforts will never lead to a sustainable solution. If we are all in this together, we have to act together, not against each other.

As the following worldmapper-style view of the world’s public debt levels shows in comparison to the population and wealth distribution (small map on the bottom right), it is a small share of the global population bringing the world into a deep financial mess. The richest nations take a huge gamble, while the economic livelihoods of the large populations in the economically disadvantaged parts of the world suffer disproportionally high from the consequences (“No country, however, is spared from the consequences of

the downturn. The impact on developing countries is even greater”, quoted from an IPC paper).

The world is changing. To make it the change for a better, we probably have to start to see things in their interrelation, so see that riots and tumbling markets, and further beyond our doorstep, also famines, wars, and many other tragedies, are all connected in one or another way. It’s today’s challenge of geography to make sense of these dimensions of the world that we still don’t fully comprehend. Will we ever be able to create a more responsible, just and humane planet?

And now calm all down (, dears) and start doing something sensible. Together.

The content on this page has been created by Benjamin Hennig. Please contact me for further details on the terms of use.