Sometimes referred to as the fourth dimension, time has a highly geographical relevance. For human geography, population sizes can have as much impact on the ‘tempo of places’ as culture or even climate. In physical geography, the concept of time is indispensable for an understanding of how the natural environment has changed and keeps changing.

In the 21st century, time has been described as being a commodity itself, affecting everything from manufacturing and trade, to financial flows and global transport links.

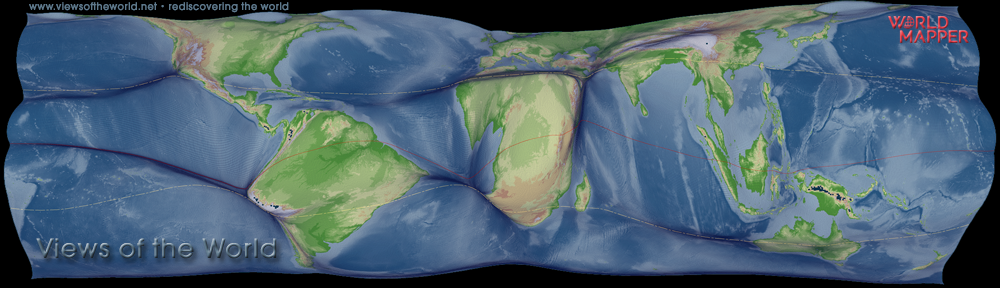

The general geographic distribution of time zones is based on the general concept of dividing the world into zones of equal time following a 24-hour day around the world. In theory, this means that there are 12 time zones of 15° width in which each differs by one hour’s time difference.

The necessity of time zones was closely linked to growing needs of transport and communication links during industrialisation. British railway companies began adopting Greenwich Mean Time (GMT) which helped to coordinate timetables. In 1880, GMT became standard across Britain and time differences of tens of minutes between cities in the country started vanishing. At a global level, time zones became established in the first decades of the 20th century.

Tag Archives: China

Demographies of China

Featured

This week I joined the Department of Asian Studies at Palacký University Olomouc (Czech Republic) as a visiting lecturer by invitation of the CHINET project. In my lecture about New Geographies of China I built on the work I have presented earlier this year at the Conference on the Socio-Economic Transition of China at the same place, teaching the students not only how China’s position is in the global context of demographic, social and economic change, but also how we can visualise this in novel ways. The following three maps are an extract from my presentation that gave an overview of this lecture.

The maps show the distribution of the different age groups in the country divided into children (age 0 to 14), working age (age 15 to 64) and elderly (above age 64) as they are counted in the official Chinese Census released by the National Bureau of Statistics. As the most recent Census figures have not been released at the same level of detail, the following three maps show the state of 2000. Here is an animated version of the three maps showing all three groups one after another (the individual maps are displayed below):

China’s gender gap

“In recent decades, the world has witnessed the enormous economic, social, cultural and political development of China. As the most populous country in the world, China’s transition process influences directly one fifth of the world’s population and indirectly almost all the rest of the world. Chinese economic activities cover the whole globe, Chinese living overseas constitute the largest diaspora, and China’s political and economic influence is significant. On the other hand, China and its government face many challenges, as Chinese society as well as the environment are affected by these massive processes.” These challenges were the theme of a Conference on the Socio-Economic Transition of China at Palacký University in Olomouc (Czech Republic) where the opportunities and potential threats for China are discussed from an interdisciplinary perspective organized by the CHINET (Forging a scientific team and international networking in the field of Chinese Studies) project.

“In recent decades, the world has witnessed the enormous economic, social, cultural and political development of China. As the most populous country in the world, China’s transition process influences directly one fifth of the world’s population and indirectly almost all the rest of the world. Chinese economic activities cover the whole globe, Chinese living overseas constitute the largest diaspora, and China’s political and economic influence is significant. On the other hand, China and its government face many challenges, as Chinese society as well as the environment are affected by these massive processes.” These challenges were the theme of a Conference on the Socio-Economic Transition of China at Palacký University in Olomouc (Czech Republic) where the opportunities and potential threats for China are discussed from an interdisciplinary perspective organized by the CHINET (Forging a scientific team and international networking in the field of Chinese Studies) project.

Part of that was an invited contribution which I prepared in collaboration with Adam Horálek of Palacký University. Our talk titled ‘Mapping Perspectives of Changing China’ presented a global as well as national context to the topic, framing China’s socio-economic place in the globalised world and highlighting some of the trends that started transforming the Chinese society considerably over the past three decades. While the most recent Census is not yet available in larger detail, we focussed on an analysis of some key aspects of the previous Census in more detail (and also discussed the quality and reliability of data from official statistics there).

The following map showing the gender gap was part of our slides (see below) and stands for one of the demographic challenges and existing tensions in the contemporary society. These are not only characterized by the changing age structures (with very distinct geographic patterns of ageing populations), but also by the considerable imbalance between the male and female population in most parts of the country. According to the most recent 2010 Census, this was at 1.18 males per female, and thus increased to the already high ratio that was stated 10 years before. In some regions, there are now over 130 men for 100 woman, with the fear (and sometimes reality), “that the excess will lead to increased sexual violence, general crime and social instability” (quoted from the Guardian). It is very much a man-made problem as in the early 1980s the ratio was at 108:100 and therefore only slightly above the natural rate, after which the 1979 introduced one child policy started having an effect that we see in its full extent today. This map, showing the sex ratio on an equal population projection (a gridded cartogram transformation where each grid cell is resized according to the total number of people in an area). It reveals, that the surplus of men is common throughout the country, while the opposite (a considerable surplus of women) is true for very few of the populated spaces in China (such as in the Shenzhen area of the Pearl River Delta where female migrants are the majority of workers under precarious employment conditions).

The authorities appear to become aware of the emerging problems, and according to the Guardian article, China’s “new Five Year Plan sets an ambitious target of cutting the ratio to 112 or 113 by 2016”. For the time being, the pattern in this map remains prevalent and puts pressure on a society that is feeling the full impact of China’s transformation to a new global player over the past decades.

The Pearl River Delta: A City of Cities

Earlier this year the British Telegraph Newspaper published a story about the creation of a new megacity in the Chinese Pearl River delta region. “China is planning to create the world’s biggest mega city by merging nine cities to create a metropolis twice the size of Wales with a population of 42 million”, the opener of their story stated. The region mentioned here is an area covering the cities of Guangzhou, Shenzhen, Donggaun, Foshan, Huizhou, Zhaoqing, Jiangmen, Zhongshan and Zhuhai (as described in the China Urban Development Blog). The story was quickly picked up by many news sources back then, while Chinese officials were quick to deny the reports. Stories like this show, how urbanisation and megacities have become a buzz word, and are used especially in relation to the emerging economies in Asia in order to picture these – for western-centric eyes unbelievably – large and still growing populations in the most urbanised regions on the planet. A few thoughts on the relevance of megacities in their global context have been published on this website before (related to the map of the world’s megacities).

With special regard to the Telegraph story I have drawn another map showing the population distribution of China (based on 2010 Data from the Chinese Census and from estimates of SEDAC’s GPW database) and highlighted the Pearl River Delta region in this map. The equal-population map shows a gridded population cartogram in which every grid cell is resized according to the total number of people living there. This map makes the plans of a more integrated Pearl River Delta region more understandable, and perhaps slightly less exciting for those who interpreted the news as the creation of a new megacity, rather than the logical step in connecting an already populous region.

The World of America’s Debt

The financial crisis continues to make it into the headlines. Mountains of debt piled up by the world’s wealthiest nations (as shown in this map) stir up the financial markets and indicate that political measures since the early days of the economic meltdown in 2008 had little impact or simply were too meaningless to induce a real change into the mechanisms of the markets. The EU keeps struggling to calm investors over fears of yet another country going bust while on the other side of the pond the rating agencies start playing games with the world’s largest economy. As the NYT explains, The rating agency thinks the United States has too much debt, or at least will: “Under our revised base case fiscal scenario — which we consider to be consistent with a AA+ long-term rating and a negative outlook — we now project that net general government debt would rise from an estimated 74 percent of G.D.P. by the end of 2011 to 79 percent in 2015 and 85 percent by 2021.” (read more about credit agency ratings in the A ‘AAA’ Q. and A.). After some brief debates about credit agencies not long ago, these discussions seem to have disappeared again, and the old mechanisms of nervous investors and even more nervous decision makers, like it always did in the last three years.

At the same time an emerging super power starts to find its own political voice against its perhaps largest rival: After years of growing economic dominance, China seems to gain confidence in confronting the USA with bold statements. As the largest holder of US debt, they may start to worry with the investors’ decline in trust in America, causing China to warn America over its addiction to debt.

The current American debt levels did not come out of the blue, but have long started piling up, as a look at the development of US debt over the last decade shows: The total national debt of the United States is at $14.3 trillion this year, up from $5.8 trillion in 2001. Particularly interesting for the global markets is the external debt that the USA owes to foreign holders outside the country. Here George W. Bush took over approximately $1 trillion in foreign debt from the Clinton administration (Bill Clinton managed to induce a reduction in national debt levels in his second term). After a short period in which this downward trend continued, foreign US debt started to rise after September 2001, and Bush handed over more than $3 trillion of National debt to Barak Obama in 2009, with a considerable trend upwards since the financial crisis hit the nation in 2008. Only recently this upward trend started to level off slightly, and foreign debt is now just below $4.5 trillion. Besides China, as the largest single holder of foreign US debt, the liabilities are spread around the globe, with a considerable amount of debt being held by some of the other indebted economies such as the United Kingdom (as the country with the largest external debt of European countries). The following map shows the countries of the world resized according to the total amount of US treasury securities that are held in that country. It uses the most recent data published by the US Treasury: