In an article for the “In Focus” section of Political Insight (December 2013, Volume 4, Issue 3) Jan Fichtner of the University of Frankfurt a.M. and I analysed the size of the foreign assets in the world’s largest offshore financial centres. All ‘offshore financial centres’ (OFCs) have one characteristic feature in common; they offer very low tax rates and lax regulations to non-residents with the aim to attract foreign financial assets. OFCs essentially undercut ‘onshore’ jurisdictions at their expense. The main beneficiaries are high-net-worth individuals and large multinational corporations that have the capital and expertise required to utilise OFCs. Beyond its geographical connotation the phenomenon of ‘offshore’ represents a withdrawal of public regulation and control, primarily over finance. Some important OFCs are in fact located ‘onshore’, e.g. Delaware in the USA and the City of London in the UK. However, historically many OFCs have literally developed ‘off-shore’, mostly on small islands.

In an article for the “In Focus” section of Political Insight (December 2013, Volume 4, Issue 3) Jan Fichtner of the University of Frankfurt a.M. and I analysed the size of the foreign assets in the world’s largest offshore financial centres. All ‘offshore financial centres’ (OFCs) have one characteristic feature in common; they offer very low tax rates and lax regulations to non-residents with the aim to attract foreign financial assets. OFCs essentially undercut ‘onshore’ jurisdictions at their expense. The main beneficiaries are high-net-worth individuals and large multinational corporations that have the capital and expertise required to utilise OFCs. Beyond its geographical connotation the phenomenon of ‘offshore’ represents a withdrawal of public regulation and control, primarily over finance. Some important OFCs are in fact located ‘onshore’, e.g. Delaware in the USA and the City of London in the UK. However, historically many OFCs have literally developed ‘off-shore’, mostly on small islands.

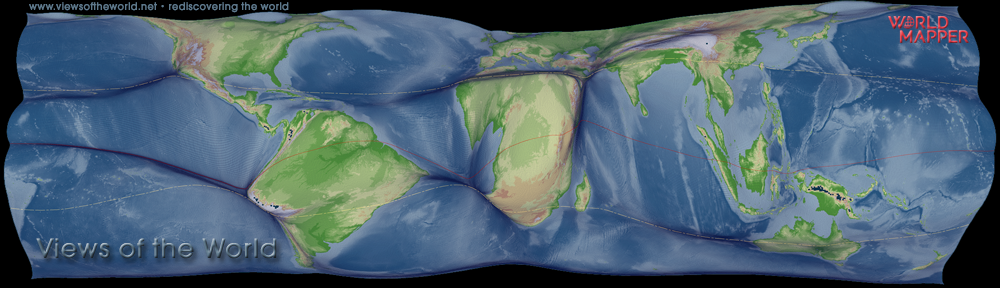

OFCs as defined by Zoromé (2007) are jurisdictions that provide financial services to non-residents on a scale that is excessive compared to the size and the financing of their domestic economies. The graphic shows combined data on securities (Coordinated Portfolio Investment Survey by the IMF) and on deposits/loans (Locational Banking Statistics by the BIS) at the end of 2011. Capturing the two by far most important components of financial centres allows a reasonable approximation of the real size of OFCs while avoiding double counting. The larger the size of the circles on the map, the more foreign financial assets have been attracted to the particular jurisdiction. The vast majority of the almost US$70 trillion foreign financial assets are concentrated in North America, Europe and Japan. Areas with assets below $US50bn are not shown for their relative insignificance in the global context.

Amid Europe’s debt crisis it remains less noticed that the largest mountain of debt in the world is piled up across the big pond in the United States of America. The topic will be critically debated in

Amid Europe’s debt crisis it remains less noticed that the largest mountain of debt in the world is piled up across the big pond in the United States of America. The topic will be critically debated in