The Eurozone crisis has made monetary issues the focal point of political debate about the nature of the European Union, not just within members of the common currency but across the 27 states that constitute the EU. Discussions about emergency bailouts and transfers to support struggling economies have distorted the public perception of the costs and benefits of the Union.

The Eurozone crisis has made monetary issues the focal point of political debate about the nature of the European Union, not just within members of the common currency but across the 27 states that constitute the EU. Discussions about emergency bailouts and transfers to support struggling economies have distorted the public perception of the costs and benefits of the Union.

The actual EU budget is based on a multiannual financial framework, negotiated among the individual members and agreed upon at the level of European institutions. The current financial framework covers the period 2007–2013. Negotiations for the framework from 2014 to 2020 are under way. These discussions are greatly influenced by the implications of the current crisis. In a feature for the “In Focus” section of Political Insight (September 2012, Volume 3, Issue 2) Danny Dorling and I looked at the current financial framework and how the money is redistributed across the member states.

Despite claims of the high costs of the EU, its overall budget represents approximately just 1 per cent of the gross national income (GNI) of all member states. Payments into the EU budget from a country should also be seen in comparison to payments that countries receive from the EU. The largest contributors, France and Germany, are also those in receipt of the largest payments from the EU budget.

Looking at net contributors, nine countries are currently paying in more than they receive from the EU budget. The remaining 18 countries are net recipients. The net benefits for those 18 countries range from around 1 per cent of gross domestic product (GDP) up to almost 5 per cent of national GDP (for Lithuania). The general policy is that the weaker economies get more (relative) financial support.

The total amount paid by the stronger economies is only a very small share of their respective national GDP. From a geographical perspective, the net redistribution of money in the European Union follows a trend from the wealthier northern countries to the economically weaker south and east of the Union. This tackles some of the prevailing imbalances within the common economic market.

Although there is a transfer of monetary resources, net payments into the EU budget from the so-called ‘paymasters’, Germany and France, remain below 0.5 per cent of their respective national levels of GDP. Among the relatively stronger economies, only Belgium, Ireland and Luxembourg were net recipients from the EU budget. (Belgium and Luxembourg benefit largely from their central roles in EU administration.)

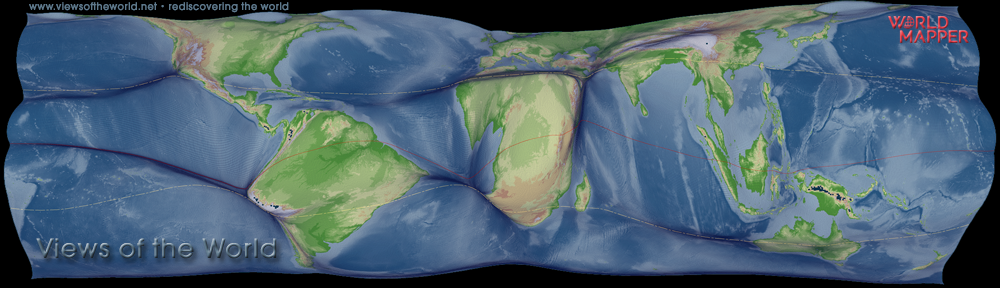

The two maps visualise the net shares of those paying into, or receiving money from, the total EU budget in form of cartograms. The bar chart shows how large these payments are in terms of each country’s respective national GDP share. The countries are sorted by the GDP per capita data for 2010, going from the lowest to the largest value from left to right in the chart (and translated into a rainbow spectrum colour scheme on the map).

Here are the bibliographic details:

- Hennig, B.D. and Dorling, D. (2012). Financing the European Union. Political Insight 3 (2): 34.

Article online (Wiley)

The content on this page has been created by Benjamin Hennig. Please contact me for further details on the terms of use.