The real estate and financial crisis is confronting the disciplines architecture and urbanism with the consequences of the close interdependence of financial markets and the building sector. In the 1990s these spatial design disciplines as well as many others were enticed by the triumph of neo-liberalism to step back from their responsibility for a sustainable spatial development in favor of the short-term profit of private investment firms. Still in the turn of the century the international URBAN 21 report had proclaimed in the mainstream of both disciplines the common goal to privatize municipal services, to offensively attract global financial capital and to predominantly follow global locational competitiveness.

The eruption of the financial capital now results in long-term distortions in socio-economic conditions, spatial patterns of regions and urban structures of utilization. After the mortgage crisis in the US vacant houses have started to announce the decline of entire residential streets and neighborhoods. In many cities camping sites have popped up, to which previous owners of housing property are taking refuge after thousands of foreclosures: They are no longer able to amortize the mortgage, that exceeds the value of their property. The living concept of suburbia is in question.

The financial crisis leads to far-reaching changes in the architectural practice and its urban fields of activity. Architectural firms around the world respond to the decreased demand with job cuts and closings of branches. Prestigious construction projects in previously booming cities like Dubai or Las Vegas are cancelled or scaled down. In the burst of the real estate bubble the building industry is suffering from drastic personnel and financial cuts. In addition massive geographic dislocations take place: Do architects and urbanists share the responsibility for the building boom in several world regions prior to the crisis?

Form Follows Finance: How far do instruments of the financial market influence the direction of architecture and urban development? What is the impact of the financial crises on urban settlements and infrastructures worldwide? What are the long-term implications for the future of architecture and urban design? (Stiftung Bauhaus)

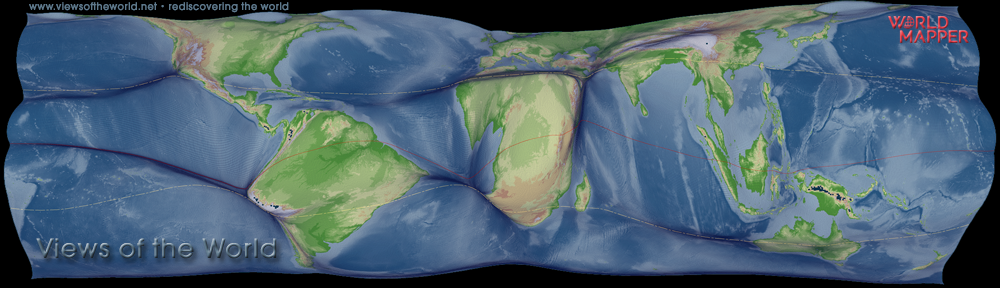

Back in late 2009 I was invited to hold a talk at a conference celebrating the 90th Bauhaus in Dessau/Germany. At the event architecture and the city in the financial crisis (that was the title of the conference) were discussed by the speakers, resulting in an interesting debate of the various disciplines that the speakers represented. My contribution was a presentation on the way how the financial crisis is taken up in the world of cartography and visualisation and how these can perhaps help to gain a better understanding of the processes and impacts of the crisis. Some examples of previous global recessions demonstrated how a crisis has especially long term implications on the urban development, such as the changing patterns in downtown Chicago show quite well. The impact of the crisis on the housing markets may be immediate and a current affair, but the implications on the urban structures will be much more a long term issue. The pictures make clear that these events do change the way we see our world. Whether we learn from it remains to be proven…

The crisis is still not a thing of the past, and the contents of my presentation are still stunningly relevant and need little update to show them yet again in a topical context today:

Note: The slides are bi-lingual English-German (as the conference was held in both languages). Some of the animated bits in this presentation are not shown in this version, as Slideshare is unable to convert the presentation properly. Don’t hesitate to contact me if you have further questions related to this talk or the maps and images shown in there.

The content on this page has been created by Benjamin Hennig. Please contact me for further details on the terms of use.