The outcome of the referendum over the United Kingdom’s membership of the European Union raises some crucial questions over the country’s economic relationship with the remaining 27 member states. Economic issues over trade were among the most heavily debated issues throughout the campaign. Now that the decision has been made, existing ties with the EU need to be carefully considered in any future trade relationship with the European Union. In a contribution for the “In Focus” section of Political Insight (December 2016, Volume 7, Issue 3) I mapped out Britain’s complex trading relations with the rest of the European Union and created a series of cartograms from the underlying statistics:

The outcome of the referendum over the United Kingdom’s membership of the European Union raises some crucial questions over the country’s economic relationship with the remaining 27 member states. Economic issues over trade were among the most heavily debated issues throughout the campaign. Now that the decision has been made, existing ties with the EU need to be carefully considered in any future trade relationship with the European Union. In a contribution for the “In Focus” section of Political Insight (December 2016, Volume 7, Issue 3) I mapped out Britain’s complex trading relations with the rest of the European Union and created a series of cartograms from the underlying statistics:

According to official UK government figures, exports accounted for 27% of Gross Domestic Product (GDP) in 2015, while imports were equal to about 29% of the country’s GDP. Of these figures, the countries of the European Union make up 44% of the exports (valued at £223.3 billion) and 53% of the imports (valued at £257.1 billion). These statistics show the strong position of the European Union as a market for the United Kingdom.

Although the UK does import more from the other member states than it exports to them, the underlying economic geographies are more complex than this. During the referendum pro-Brexit campaigners frequently treated the United Kingdom as one geographic area opposed to the other 27 nations as a whole, to highlight the even higher importance of the respective other side as part of the argument. This neglects the fundamental structure of the internal market as (still) 28 countries trading with each other without trade barriers rather than the United Kingdom trading with ‘Europe’.

According to data by Eurostat, intra-EU trade accounted for a volume of approximately €3 trillion in 2015. Regardless of net-exporting or net-importing countries, these trade relations therefore, are crucial elements of the internal market that have significant implications for each member’s economy.

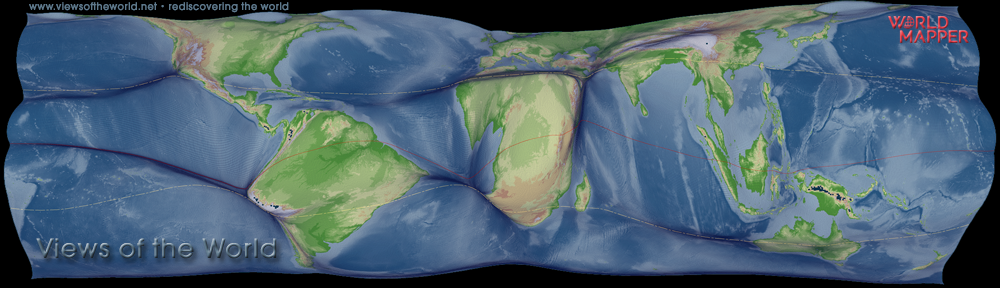

When further dissecting these figures and taking the relative contributions of each country into account, the United Kingdom (as the largest total net importer) was on a par with Greece, with approximately 60% of the value of goods exported compared to the imports. In relative terms only Croatia (53%), Malta (31%) and Cyprus (23%) were below the UK, each of which are far less strong exporting nations (see main map above). On the other end of the spectrum, the Netherlands were in absolute and relative terms the largest net exporting member state in internal trade relations. The surplus of exports accounted for 184% compared to the imports in 2015. Ireland came second with approximately 131% trade surplus in intra-EU trade.

The UK’s position in intra-EU trade might look imbalanced but this is not a uniquely British phenomenon: France is also a net importer in absolute terms (as shown in the cartogram of net imports above). The importance of intra-EU trade for the net exporting member states is more heterogeneous. A block of countries ranging from Belgium and the Netherlands, via Germany to the emerging Eastern European economies, are the major players in absolute terms, with intra-European trade playing a much smaller role for Germany than its overall dominant GDP figures would have suggested (see the cartogram of net exports in the maps above).

When changing the perspective to the trade relations of the United Kingdom with individual member states, these trading patterns become even more interesting as shown in the following series of three cartograms:

UK exports to other EU states are spread widely across the Union. In 2015 Germany was the largest destination for British exports in intra-EU trade (approximately 20% of goods and services). Significant amounts of exports also go to countries that run a trade deficit within the intra-EU trade, such as approximately 14% of exports going to France and 7% of exports going to Spain. The trade balance with other EU countries is very polarised. The UK has a trade surplus with only six of the other 27 EU member states, of which in absolute terms the trade with Ireland is the most important. The trade with the only country with a land-border to the UK runs at a surplus of 148% compared to the imports from there. Only Malta runs a higher trade deficit with the UK (187%), but at a much lower absolute volume.

The complex trading patterns show how much more difficult untangling these relationships will become when negotiating possible future scenarios. Trade between the UK and the other 27 member states is not a two directional relationship, but a network of 28 countries that are embedded in these complexities of net exports and net imports: Ireland as Britain’s most important European trading partner in relative terms may run a trade deficit with Britain, but a trade surplus with the rest of the EU. Access to affordable goods and therefore to some extent, the standard of living for Britain’s consumers in contrast are fuelled by the net imports from countries such as Spain, Belgium, the Netherlands. The same is true for Germany as Britain’s largest intra-EU trading partner, while Britain plays a much less important role in the intra-European trade of Germany. How vulnerable this interrelationship has become became apparent with fluctuations of the exchange rate after June 23.

The figures show that the internal market cannot be ignored in any post-Brexit trade relationship between the UK and the European partners. These interrelations are deeply embedded in the current structure of the British economy. Untangling the links that have grown over 43 years of membership within two years of negotiation is going to be a challenging task.

The bibliographic details of the paper are:

- Hennig, B. D. (2016): In Focus: Trade Inside the European Union. Political Insight 7 (3), 20-21. Full article online (Sage)

The content on this page has been created by Benjamin D. Hennig. Please contact me for further details on the terms of use.

Pingback: Map of the day: European Union internal trade | eats shoots 'n leaves