Housing has always been a decisive and sometimes divisive political issue. Home ownership has of course long been an aspiration for many people, and in the post-war period between 1953 and 1971 the number of households renting and owning reached an equal level, as documented in official census statistics for England and Wales. Ownership then surpassed renting, reaching its peak in 2001 at 69%. In the decade that followed, this number went down to 64%. The following two maps show the ownership rate in the UK in a conventional and an equal population projection:

According to the most recent census of home owners in the whole of the United Kingdom, most live in properties owned with a mortgage or loan rather than owning a place outright: 40% of residents own a property with a mortgage or loan (equal to 33% of households); while 26% live in properties that are owned outright.

England has the highest share of residents living in properties rented from a private landlord or letting agency: 16% live this way. London particularly stands out, with more than half of all households (50.4%) renting in the capital, followed by the northeast of England with 37.8%.

House prices and the overall economic situation of people are the most influencing factor in these developments. Looking at long-term trends, data from the Land Registry shows that 20 years ago average house prices in London were at £92,000 at the start of the year, and there was no English region where the average value of property was less than half the average value in London. By 2005, average property prices in London had increased to around £275,000, now more than twice the value of average property in every other English region, apart from the southeast and southwest. These prices across the country reached an average of around £170,000 per property, 2.6 times the average price a decade earlier. Although the financial crash brought some consolidation on the housing market, with a low point in sales in early 2009, by 2015 the prices were already back to the pre-crisis levels that made owning a property less and less affordable for an ever growing amount of the population.

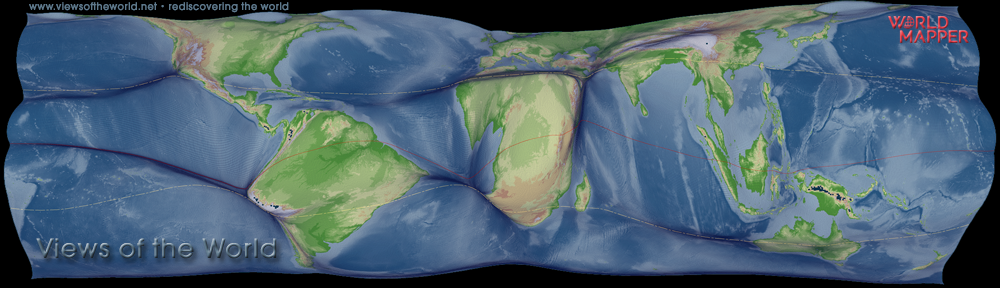

These two maps show the British world of owning versus renting in the United Kingdom using official census statistics. Mapped are the shares of home ownership among households (including those owning either outright or with a mortgage/loan, or on a shared ownership). The basemap used in the cartogram on the far left is an equal population projection, based on a gridded cartogram transformation where each grid cell is resized proportionally according to the number of households in that particular area. The second map shows the same data but on a regular sized UK map for comparison.

The maps show that renting is more prevalent in the densely populated urban areas, but also that the trend to a majority of households renting their home is widespread across the country, from Glasgow in the north to the inner parts of London. The peak of ownership reached in 2001 now seems a distant past, with close to half the households now renting in the urban centres across the United Kingdom.

A modified version of this map was published in the August 2016 issue of Geographical Magazine. The content on this page has been created by Benjamin Hennig. Please contact me for further details on the terms of use.