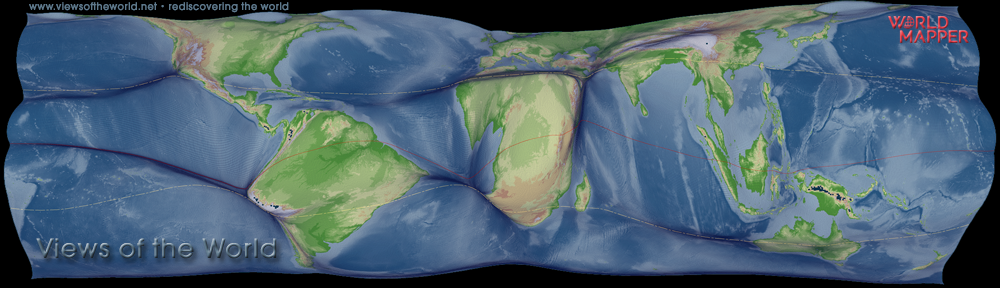

Housing has always been a decisive and sometimes divisive political issue. Home ownership has of course long been an aspiration for many people, and in the post-war period between 1953 and 1971 the number of households renting and owning reached an equal level, as documented in official census statistics for England and Wales. Ownership then surpassed renting, reaching its peak in 2001 at 69%. In the decade that followed, this number went down to 64%. The following two maps show the ownership rate in the UK in a conventional and an equal population projection:

Tag Archives: housing

Rising high: A brief history of the housing market

House price monopoly would be a better name for what has turned into a defining political issue ahead of the 2015 general election. As the ONS states in its latest release of long-term housing sales data, “the average price of sold houses in England and Wales has more than doubled since 1995” and “nearly a million properties were sold in 2013.” The dynamics of the housing market is about more than people looking for a place to live. It has become a substantial part of the British economy.

The following cartogram animation puts this trend into a vivid perspective. It shows the absolute value of all housing stock sold in a year for the regions of England as well as the boroughs of London, which itself becomes ever more dominant over the past two decades. Only in economic weaker times it loses some of its pace compared to the rest of England, but stays way ahead of any other region. The animation also takes the absolute value displayed in each map into account by resizing England according to the total value represented in each map, so that the full cartogram itself grows (and shrinks after the crash in 2008) over time:

In Focus: The London Housing Bubble

In an article for the “In Focus” section of Political Insight (April 2014, Volume 5, Issue 1) Danny Dorling and I looked at the overheating of the housing market in London. The graphics that I created for this feature visualise the considerable changes that took place in recent years using data from an analysis reported in the Guardian: In 2012, the total value of residential property in London was reported to be £1.37 trillion. The value of housing in the capital dominated the UK housing market. By 2013, the value of London housing had risen to £1.47 trillion. Some £100 billion had been added in just one year, an additional £30,000 per property if the rise had been evenly spread out across the capital. However, just as within England, this increase was concentrated within certain areas, particularly those closest to the centre.

In an article for the “In Focus” section of Political Insight (April 2014, Volume 5, Issue 1) Danny Dorling and I looked at the overheating of the housing market in London. The graphics that I created for this feature visualise the considerable changes that took place in recent years using data from an analysis reported in the Guardian: In 2012, the total value of residential property in London was reported to be £1.37 trillion. The value of housing in the capital dominated the UK housing market. By 2013, the value of London housing had risen to £1.47 trillion. Some £100 billion had been added in just one year, an additional £30,000 per property if the rise had been evenly spread out across the capital. However, just as within England, this increase was concentrated within certain areas, particularly those closest to the centre.

When London is redrawn with each borough sized according to the value of residential property, the largest borough becomes Kensington and Chelsea where the average home now costs £1.57 million. Westminster, with more housing but an average value of ‘only’£1.1 million is almost as large. Wandsworth, more typical at £527,000 a home, is more than three times the size of Newham despite having just 30 per cent more homes. However, even in Newham, the ‘cheapest borough’, the average property now sells for over £218,000.