Commentators have suggested that the Commonwealth could become more important for UK trade after Brexit. This article for Political Insight (June 2018, Volume 9, Issue 2) maps the current state of British-Commonwealth trade and finds a more mixed picture of UK-Commonwealth trade relations.The Commonwealth of Nations (hereafter referred to as the Commonwealth) has received increased levels of interest in the United Kingdom in the runup to and even more so since the vote for leaving the European Union in 2016. As an intergovernmental organisation working based on consensus and with very limited institutionalised structures, it constitutes a very loose and uncommitted association of its 53 member states. In this regard it is an almost opposite model to the European Union with its increasingly complex intertwined structures that bind the member states together.

Commentators have suggested that the Commonwealth could become more important for UK trade after Brexit. This article for Political Insight (June 2018, Volume 9, Issue 2) maps the current state of British-Commonwealth trade and finds a more mixed picture of UK-Commonwealth trade relations.The Commonwealth of Nations (hereafter referred to as the Commonwealth) has received increased levels of interest in the United Kingdom in the runup to and even more so since the vote for leaving the European Union in 2016. As an intergovernmental organisation working based on consensus and with very limited institutionalised structures, it constitutes a very loose and uncommitted association of its 53 member states. In this regard it is an almost opposite model to the European Union with its increasingly complex intertwined structures that bind the member states together.

The rekindled interest in the Commonwealth was outlined by Theresa May in her Lancaster House speech in early 2017, where she made these direct links between the government’s Brexit plans and the narrative of a ‘Global Britain’ with the Commonwealth being ‘a reminder of [Britain’s] unique and proud global relationships’. While a 2009 survey across major Commonwealth nations conducted by the Royal Commonwealth Society showed a largely ignorant attitude towards the organisation and its future, it was mostly the smaller and developing or emerging economies that showed (relatively) higher levels of support.

The economic argument appears to be the major driver in this government rhetoric about the relevance of the Commonwealth. It appears almost like a revealing acknowledgement of the importance of some form of institutionalised collaboration of nations in a globalised world to retain economic and political significance.

With its historic roots the Commonwealth provides the UK with a platform where British identity is highly present – arguably much more than it has ever been in the EU – while also having a certain established global relevance through its geographical dispersion and other key characteristics. These include the large number of members (53), a large share of the world’s population (2.4 billion) and the member states’ combined economic size (depending on the measure accounting for approximately 15% of global GDP). This makes the Commonwealth an attractive institution to turn towards from a British perspective.

These overall statistics must be relativized though, since they give a distorted picture of the more disparate realities. By population, India weighs heavily, a large share of the countries are small island nations, and the levels of economic development range from Malawi’s per capita GDP of U$ 326 to Australia with over 56,000 U$ per capita. In terms of economic power, India is set to surpass the UK’s total GDP in 2020.

When looking more specifically at the UK’s trade relationships with its Commonwealth partners, an almost constant rise in overall trade of goods and services could be observed in the decade from 2000 to 2010, after which both exports and imports went down again slightly. In 2011 the UK reached a small positive trade balance in its trade with the Commonwealth for the first time in the period since 2000. In relative terms, exports accounted for 8.9% and imports for 7.8% of the total trade in goods and services. Exports are therefore at a similar share as it was at the start of the century, while imports went down slightly resulting in this recent positive trade balance.

As a House of Commons Library Briefing noted, exports to the Commonwealth are at similar levels as exports to Germany, and imports are at levels that compare to those from China. Therefore, trade with the Commonwealth can be regarded as relatively low compared to that with the EU (43.1% of exports in 2016, 54.9% of imports).

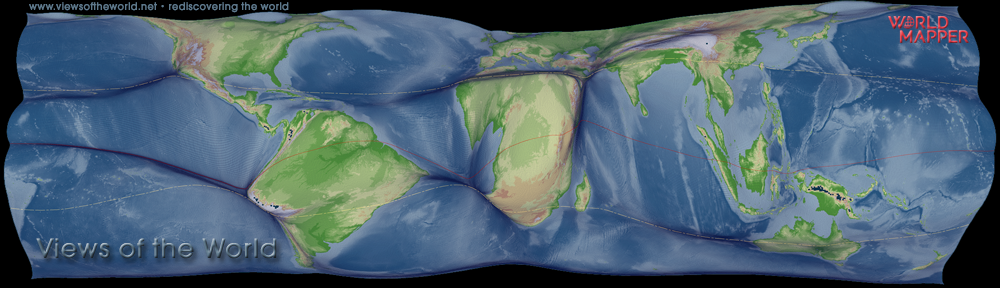

Understanding trade with the Commonwealth also requires further geographical differentiation. UK exports to the Commonwealth are concentrated of few countries that are more heavily traded with, as shown in the cartogram that shows the quantitative dimension and the relative shares of UK exports and the Commonwealth trading partners.

This picture of trade becomes even more disparate when looking at the trade balances as shown in the pair of cartograms on UK-Commonwealth trade that show the distribution of individual surplus and deficit in trade relationships. While there has been a modest overall Commonwealth trade surplus in recent years, this is largely dependent on trade with few countries, such as Australia, Singapore, and Canada, which account for ¾ of the overall trade surplus. At the same time does the deficit in trade with India alone account for more than 45% of the negative trade balance with Commonwealth countries that the UK has a trade deficit with.

The positive balance of trade relationships is heavily dependent on trade with wealthier Commonwealth countries. In contrast, some of the most important developing and emerging economies especially in South Asia are benefiting more from trade with the UK than the other way around.

Treating the Commonwealth as a homogenous and coherent block that provides opportunities for future trade relationships therefore must be seen with caution. This is not only because of the political limitations of building a more consistent relationship between these geographically widespread countries, but also because of the heterogeneity of the existing trading patterns within the Commonwealth that these figures demonstrate.

From a political perspective, the relevance of the Commonwealth for the UK’s global engagement may increase out of necessity. At the same time do many of the Commonwealth nations participate in other regional projects of integration, such as the EU (that Malta and Cyprus continue being members of), the Caribbean Community, Southern African Customs Union, East African Community, and the South Asian Association for Regional Cooperation that some of the Commonwealth nations engage in. This therefore speaks more for a continuation of the organisation’s role as a loose non-legally binding platform that collaborates more on a number of societal levels. An increased political or economic integration as a replacement for the UK’s membership of the EU appears a very unlikely prospect at the moment.

The formal decision to agree on Prince Charles being the next head of the Commonwealth of Nations is not least one further symbolic sign of the organisation’s slow pace of moving on from being a construct that emerged from the decolonisation of the British Empire. A growing confidence of its emerging powers, such as India, would need to be the first step to changing the functioning of the Commonwealth towards a more balanced but at the same time more relevant voice in the global cobweb of intergovernmental organisations.

Bibliographic details for the original publication that this blog entry is based on:

- Hennig, B.D. (2018). In Focus: Could Brexit be a Boon for British trade with the Commonwealth? Political Insight 9 (2): 24-25.

DOI 10.1177/2041905818779330 (Sage)

The content on this page has been created by Benjamin Hennig. Please contact me for further details on the terms of use.