Some recent maps on this website were closely related to the direct or indirect implications that the global downturn had on people’s lives across the globe: Be it the slowed-down but still growing carbon emissions, the poor state of well-being seen from a more sustainable point of view, or the distribution of wealth.

How this all related to each other has recently been commented by Peter Victor in Nature, who argues that “our global economy must operate within planetary limits to promote stability, resilience and wellbeing, not rising GDP” (Questioning economic growth, Nature 468: 370–371).

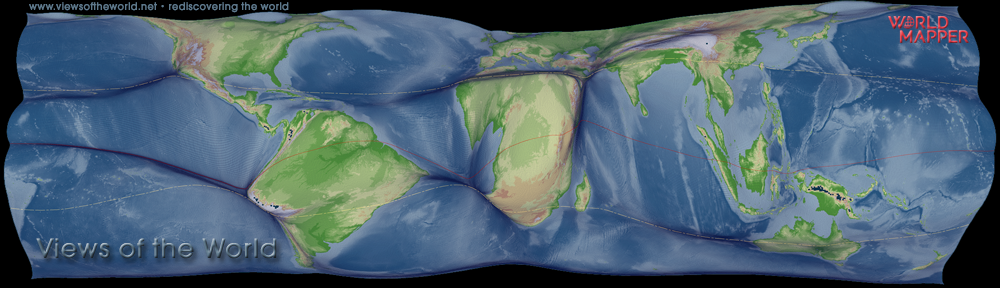

The previously published GDP map on the global distribution of GDP for 2010 and 2015 gives a good indication how little the distribution of global wealth has changed, and where the nations of the world are that may reconsider their attitude towards further growth. The map is less useful to see the dimension of changes and to see how little things have changed so far: The rich countries getting richer and the poor countries trying to catch up with these developments – and still, rising levels of global inequalities and further socio-economic disparities. This is shown in the following map, which displays the absolute growth derived from the GDP estimates for 2010 and 2015. The map thus shows the countries resized to the total growth that is expected for all countries in the given timespan and gives a clear picture of where the growth is largest (apparently, G20 countries dominate much of this cartogram. The colour key for the countries adds another dimension by showing the rate of growth reached 2015 compared to the level of 2010, an indicator that shows the most dynamic economies in the years to come – and those which kept on producing more carbon emissions despite the recession:

Tag Archives: economy

GDP Changes 2010-2015

Europe in debt

People across the worst hit countries by the proposed austerity measures to reduce national debt levels gathered on the streets of many European cities to protest against public spending cuts. The financial crash hugely affected many government across the EU with little signs of a quick recovery of the public debt levels.

The following map shows how Europe is left in deficit two years after Lehman (and that in fact the EURO zone isn’t worse off than EU members without the common currency). There may be signs of recovery, but this picture will certainly stay with us for a while:

Worldcup Economics

The Football Worldcup is claimed to have a significant impact on the global economy, one of the reasons why so many countries are keen on hosting this event. Others are looking at the relationship between GDP and performance of teams at the Football Worldcup, which is well worth mapping. Here is a map that shows the participating countries of the 2010 Football Worldcup resized according to their Gross Domestic Product. In addition, all countries are coloured in different shadings of green – the darker green, the further the respective national team has proceeded in this year’s tournament. Obviously, economic wealth alone can’t buy success:

The previous map is of course missing out all other countries of the world. To complete the picture, the following map shows the same economic data (GDP), this time for the whole world, with the 32 nations participating in the 2010 Worldcup being coloured white, and those who missed out in black. The winners so far are marked with yellow stars (the number of stars indicating the numbers of trophys that a team has won at FIFA Worldcup tournaments):

Even if there may be links between economic wealth and success in football, this alone can hardly be the whole explanation for a team’s fortune. Interesting nevertheless to see, how the football world compares beyond the borders of the game.

The content on this page has been created by Benjamin Hennig. Please contact me for further details on the terms of use.

Capitalism in Crisis?

The following two maps show the countries of Europe and the World resized according to their total external debt, whereas the colours indicate a country’s debt by gdp ratio. The maps are an outcome of a commissioned work for the Times newspaper, and putting those two slightly different values on one map may raise criticism, even if both values on it’s own make for a good depiction of the current state of the economic world – or the burden that some national governments currently face. Also, the data used must be judged carefully. Not just since Greece went on the global stage with its crisis it is quite obvious that economic statistics do not always reveal the real truth. Having said all that, these maps still draw an impressive picture of the current crisis in Europe and the world:

Global Debt in 2010

Following the map of Europe’s external debt, here comes the same data put into global context. This map is a modified version of a work that has been made for the Times newspaper (featured in the printed edition on March, 25) in their coverage of the 2010 budget. As this picture shows, it is not only the Eurozone, but most Western countries in a deep crisis – global inequalities the other way around this time – this is a topic that will be with us for months (and years) to come and still a long way to go on the road to recovery. So, keep this picture in mind:

(click map for a larger view)

(click map for a larger view) (click map for a larger view)

(click map for a larger view) (

(