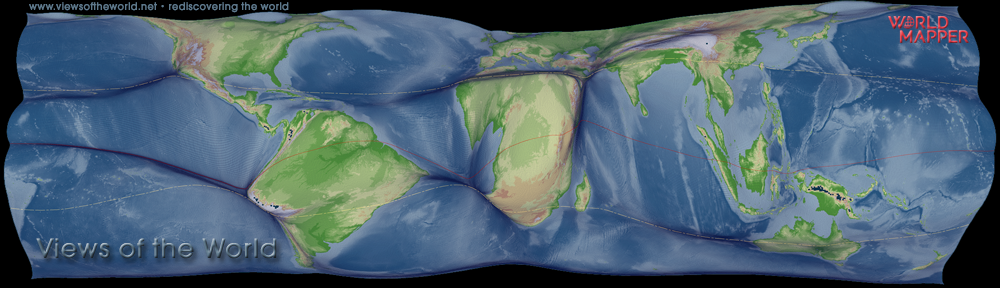

In an article for the “In Focus” section of Political Insight (April 2013, Volume 4, Issue 1) Danny Dorling and I looked at the global geography of wealth. The map that I created for this feature displays data published by Forbes Magazine in spring 2012 (updated annualy). For 2012 Forbes counted 1153 billionaires across the globe (this figure includes families, but excludes fortunes dispersed across large families where the average wealth per person is below a billion). The total wealth of the billionaires was US$3.7 trillion – as great as the annual gross domestic product of Germany. Top of this league table is the US with 424 billionaires (or billionaire families), followed by Russia (96) and China (95). The following cartogram animation shows, how the distribution of billionaires and the distribution of their total wealth compares. Although there are only small changes between the two maps, it is quite apparent that the wealthiest in the wealthier parts of the world accumulate slightly higher shares of wealth than those living in the emerging economies such as China (though this may be some of the less worrying inequalities that exist globally):

In an article for the “In Focus” section of Political Insight (April 2013, Volume 4, Issue 1) Danny Dorling and I looked at the global geography of wealth. The map that I created for this feature displays data published by Forbes Magazine in spring 2012 (updated annualy). For 2012 Forbes counted 1153 billionaires across the globe (this figure includes families, but excludes fortunes dispersed across large families where the average wealth per person is below a billion). The total wealth of the billionaires was US$3.7 trillion – as great as the annual gross domestic product of Germany. Top of this league table is the US with 424 billionaires (or billionaire families), followed by Russia (96) and China (95). The following cartogram animation shows, how the distribution of billionaires and the distribution of their total wealth compares. Although there are only small changes between the two maps, it is quite apparent that the wealthiest in the wealthier parts of the world accumulate slightly higher shares of wealth than those living in the emerging economies such as China (though this may be some of the less worrying inequalities that exist globally):

Looking at similar data collected by WealthInsight (extracts published in the Guardian newspaper) – which published more detailed statistics on the geographic distribution of 521 of the wealthiest billionaires – we can see that the plutocrats’ global city of choice is Moscow with 78 billionaire residents, followed by New York City (58), Hong Kong (40), and London (39). The most attractive place for foreign wealth appears to be the United Kingdom with 15 different nationalities represented in the richest of the rich there. This tops even Switzerland (14 nationalities) and the United States (9).

Much of the wealth of billionaires is held offshore and their wealth is the tip of an iceberg of hard-to-tax personal assets. In a recent Tax Justice Network report (pdf), James Henry estimated the overall global offshore financial assets held by the world’s richest to be between US$21 trillion and US$32 trillion (out of the total global wealth, estimated at US$231 trillion). Nearly half of these offshore assets are owned by the world’s richest 91,000, just 0.001% of the global population.

The distribution of this wealth is a story of extreme inequality. For each billionaire there are millions of people who can only ever dream of such wealth – the ratio is only slightly smaller in the richest countries of the world: in the USA one billionaire can be found for every 740,000 people, while in India one billionaire is found amongst every 26 million people.

Over time the inequalities in the distribution of global wealth have become ever more polarised. According to a 2006 study by the United Nations University (UNU-WIDER), half of all global household wealth was owned by the richest 2% of adults. The poorer half of the world’s population owned just 1 per cent of the global wealth between all of them. Their distribution is the reverse image of the wealth maps shown here.

But it is not only wealth inequality that becomes very apparent in these numbers. The gender gap is large among the rich: Of the countries with more than 10 billionaires, Sweden is the most equal. But even here only 27% of billionaires are female, followed by Germany (20%) and Brazil (19%). Russia, home to the second largest number of billionaires, only has one woman in the ranking, and the USA is not much better with only 10% of the country’s billionaires female. 37 of the 59 countries shown here have no female billionaires at all.

Here are the bibliographic details:

- Hennig, B. D. and Dorling, D. (2013). In Focus: The World’s Billionaires. Political Insight 4 (1): 38.

Article online (Wiley)

The content on this page has been created by Benjamin Hennig. Please contact me for further details on the terms of use.