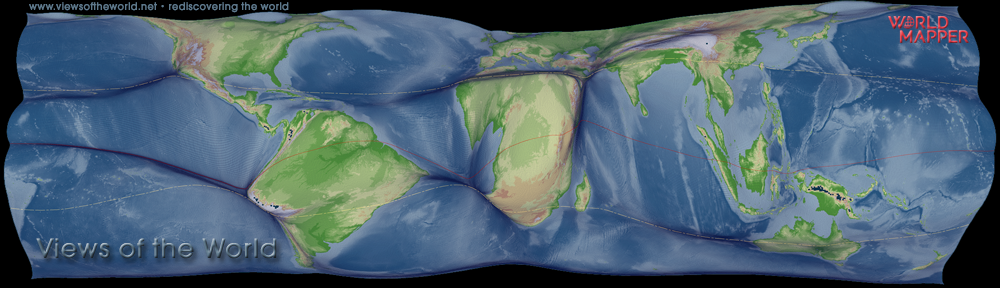

7.6 billion people producing an estimated global GDP of 131 trillion dollars (measured in purchasing power parity), that is the world in 2018. In its latest forecast, the International Monetary Fund predicts predicts a continuing global economic growth of 3.9%, while according to the United Nations Population Division an extra 83 million people will populate this planet (1.9% growth). The following two cartograms show, how the distribution of wealth and people looks this year by resizing each country according to the total number of people (top)/GDP output (bottom):

Tag Archives: wealth

The World in 2016

The world is ever changing. This year, we live on a planet of 7.4 billion people who contribute products and services worth approximately US$80 trillion in nominal terms. However, population and wealth as measured in GDP activity are not distributed equally across the world which remains one of the challenges of our time. The following two cartograms illustrate this by highlighting where people are and where in contrast GDP wealth is made – the unequal distributions in our world today are quite obvious:

Changing Poverty and Wealth in England

“England is increasingly divided between the rich and the poor, with a 60% increase in poor households and a 33% increase in wealthy households. This has come at a time – 1980 to 2010 – when the number of middle-income households went down by 27%.” In a Londonmapper report that was featured in today’s Observer newspaper we showed how the groups of poor and wealthy and the remaining ‘middle’ have changed in England over the past three decades.

These two charts, showing the absolute and relative changes in the number of households in each group, highlight that poor and middle households have come to being almost equally large groups in the British capital in the period, with a clear trend in growing numbers of poor and wealthy households and a shrinking middle part. These polarising trends of growing inequality are not only prevalent in London, but also continue in the rest of the country. The following cartogram visualisation uses the absolute changes between 1980 and 2010 and shows how the increase in poverty and wealth compares across the regions of England and the Borough of London and looks at the decline in the middle in the same way. How the middle is squeezed out of London becomes particularly apparent in these images, as London dominates much of the map while growing numbers of poor and wealthy households are more evenly distributed across the country:

In Focus: Wealth on the British Isles

Featured

The debate about the relevance and impact of the super-rich on society has gained greater currency as evidence continues to grow that the widening gap between the poor and the rich has a negative impact on societies as a whole. In otherwise affluent countries where the richest one per cent owns the most, child poverty is common, school attainment is lower and medium household incomes are depressed. Along with reduced average living standards, housing is of poorer quality, and health suffers as anxiety rises.

The debate about the relevance and impact of the super-rich on society has gained greater currency as evidence continues to grow that the widening gap between the poor and the rich has a negative impact on societies as a whole. In otherwise affluent countries where the richest one per cent owns the most, child poverty is common, school attainment is lower and medium household incomes are depressed. Along with reduced average living standards, housing is of poorer quality, and health suffers as anxiety rises.

In an article for the “In Focus” section of Political Insight (December 2014, Volume 5, Issue 3) Danny Dorling and I looked beyond the economic, social, educational and medical implications, focussing on the geographical lessons to learn when wealth concentrates. Where the richest of the rich live, work and where they keep their assets is even more imbalanced than the wider and growing underlying inequalities between rich and poor. In societies where the rich have less they tend to be more spread out across a country, but when the wealth of those at the top rises greatly there is a tendency to congregate – with London a prime example.

Unequal wealth: Income distribution gaps in Europe

Income inequality has become a wider acknowledged issue in the wealthy parts of the world which is no longer restricted to academic debate. A study commissioned by the IMF (Berg et al, 2011) acknowledges that “the trade-off between efficiency and equality may not exist” (IMF), referring to inequality one possible result of unsustainable growth. Europe has seen a steep rise in economic inequalities which have a huge impact of the people in the European nations. An OECD working paper (Bonesmo Fredriksen, 2012) states that “poor growth performance over the past decades in Europe has increased concerns for rising income dispersion and social exclusion”. It also concludes, that “towards the end of the 2000s the income distribution in Europe was more unequal than in the average OECD country, albeit notably less so than in the United States”, stressing that within-country inequalities are just as important if not more important than the between-country dimension. Both, however, are relevant in the current economic crisis and the again-growing divisions on the continent. As one of the reasons for these changes, the OECD paper states that “large income gains among the 10% top earners appear to be a main driver behind this evolution”.

Income inequality has become a wider acknowledged issue in the wealthy parts of the world which is no longer restricted to academic debate. A study commissioned by the IMF (Berg et al, 2011) acknowledges that “the trade-off between efficiency and equality may not exist” (IMF), referring to inequality one possible result of unsustainable growth. Europe has seen a steep rise in economic inequalities which have a huge impact of the people in the European nations. An OECD working paper (Bonesmo Fredriksen, 2012) states that “poor growth performance over the past decades in Europe has increased concerns for rising income dispersion and social exclusion”. It also concludes, that “towards the end of the 2000s the income distribution in Europe was more unequal than in the average OECD country, albeit notably less so than in the United States”, stressing that within-country inequalities are just as important if not more important than the between-country dimension. Both, however, are relevant in the current economic crisis and the again-growing divisions on the continent. As one of the reasons for these changes, the OECD paper states that “large income gains among the 10% top earners appear to be a main driver behind this evolution”.

The following two maps compare the share of income of the richest and poorest 10% of the population in Europe based on national-level data published by Eurostat (2013) (map legend ranked by quartiles). To show the data from a people’s perspective, the map uses a population cartogram as a base which shows the countries resized according to their absolute population. The maps give a look at how disparities exist not only between the countries, but also within each of them by showing, how (un)equal the distribution of income is in every country:

In Focus: The World’s Billionaires

In an article for the “In Focus” section of Political Insight (April 2013, Volume 4, Issue 1) Danny Dorling and I looked at the global geography of wealth. The map that I created for this feature displays data published by Forbes Magazine in spring 2012 (updated annualy). For 2012 Forbes counted 1153 billionaires across the globe (this figure includes families, but excludes fortunes dispersed across large families where the average wealth per person is below a billion). The total wealth of the billionaires was US$3.7 trillion – as great as the annual gross domestic product of Germany. Top of this league table is the US with 424 billionaires (or billionaire families), followed by Russia (96) and China (95). The following cartogram animation shows, how the distribution of billionaires and the distribution of their total wealth compares. Although there are only small changes between the two maps, it is quite apparent that the wealthiest in the wealthier parts of the world accumulate slightly higher shares of wealth than those living in the emerging economies such as China (though this may be some of the less worrying inequalities that exist globally):

In an article for the “In Focus” section of Political Insight (April 2013, Volume 4, Issue 1) Danny Dorling and I looked at the global geography of wealth. The map that I created for this feature displays data published by Forbes Magazine in spring 2012 (updated annualy). For 2012 Forbes counted 1153 billionaires across the globe (this figure includes families, but excludes fortunes dispersed across large families where the average wealth per person is below a billion). The total wealth of the billionaires was US$3.7 trillion – as great as the annual gross domestic product of Germany. Top of this league table is the US with 424 billionaires (or billionaire families), followed by Russia (96) and China (95). The following cartogram animation shows, how the distribution of billionaires and the distribution of their total wealth compares. Although there are only small changes between the two maps, it is quite apparent that the wealthiest in the wealthier parts of the world accumulate slightly higher shares of wealth than those living in the emerging economies such as China (though this may be some of the less worrying inequalities that exist globally):