In an article for the “In Focus” section of Political Insight (December 2013, Volume 4, Issue 3) Jan Fichtner of the University of Frankfurt a.M. and I analysed the size of the foreign assets in the world’s largest offshore financial centres. All ‘offshore financial centres’ (OFCs) have one characteristic feature in common; they offer very low tax rates and lax regulations to non-residents with the aim to attract foreign financial assets. OFCs essentially undercut ‘onshore’ jurisdictions at their expense. The main beneficiaries are high-net-worth individuals and large multinational corporations that have the capital and expertise required to utilise OFCs. Beyond its geographical connotation the phenomenon of ‘offshore’ represents a withdrawal of public regulation and control, primarily over finance. Some important OFCs are in fact located ‘onshore’, e.g. Delaware in the USA and the City of London in the UK. However, historically many OFCs have literally developed ‘off-shore’, mostly on small islands.

In an article for the “In Focus” section of Political Insight (December 2013, Volume 4, Issue 3) Jan Fichtner of the University of Frankfurt a.M. and I analysed the size of the foreign assets in the world’s largest offshore financial centres. All ‘offshore financial centres’ (OFCs) have one characteristic feature in common; they offer very low tax rates and lax regulations to non-residents with the aim to attract foreign financial assets. OFCs essentially undercut ‘onshore’ jurisdictions at their expense. The main beneficiaries are high-net-worth individuals and large multinational corporations that have the capital and expertise required to utilise OFCs. Beyond its geographical connotation the phenomenon of ‘offshore’ represents a withdrawal of public regulation and control, primarily over finance. Some important OFCs are in fact located ‘onshore’, e.g. Delaware in the USA and the City of London in the UK. However, historically many OFCs have literally developed ‘off-shore’, mostly on small islands.

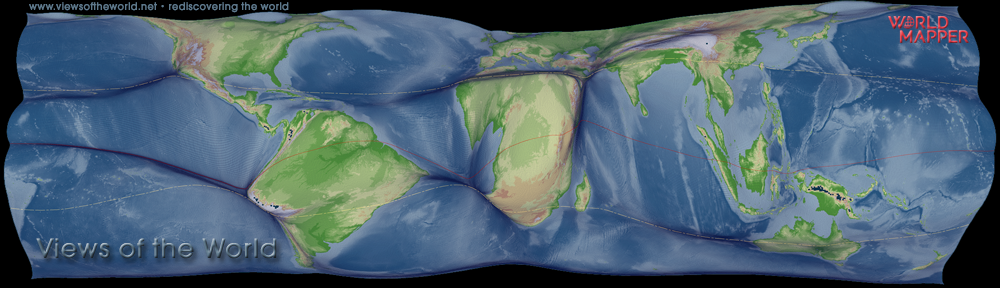

OFCs as defined by Zoromé (2007) are jurisdictions that provide financial services to non-residents on a scale that is excessive compared to the size and the financing of their domestic economies. The graphic shows combined data on securities (Coordinated Portfolio Investment Survey by the IMF) and on deposits/loans (Locational Banking Statistics by the BIS) at the end of 2011. Capturing the two by far most important components of financial centres allows a reasonable approximation of the real size of OFCs while avoiding double counting. The larger the size of the circles on the map, the more foreign financial assets have been attracted to the particular jurisdiction. The vast majority of the almost US$70 trillion foreign financial assets are concentrated in North America, Europe and Japan. Areas with assets below $US50bn are not shown for their relative insignificance in the global context.

The Eurovision song contest voting patterns is a popular theme for the analysis of European identity and culture. In an article for the “In Focus” section of

The Eurovision song contest voting patterns is a popular theme for the analysis of European identity and culture. In an article for the “In Focus” section of

In an article for the “In Focus” section of

In an article for the “In Focus” section of

George Osborne’s

George Osborne’s

The Eurozone crisis has made monetary issues the focal point of political debate about the nature of the European Union, not just within members of the common currency but across the 27 states that constitute the EU. Discussions about emergency bailouts and transfers to support struggling economies have distorted the public perception of the costs and benefits of the Union.

The Eurozone crisis has made monetary issues the focal point of political debate about the nature of the European Union, not just within members of the common currency but across the 27 states that constitute the EU. Discussions about emergency bailouts and transfers to support struggling economies have distorted the public perception of the costs and benefits of the Union.